How to Find a Good Auto Loan Rate: Your Complete Guide to Car Financing

When it comes to purchasing a vehicle, finding a good auto loan rate is one of the most important steps to ensure you’re making a financially sound decision. Whether you’re buying a brand-new car or a used one, the terms of your auto loan can have a significant impact on your long-term financial health. In this guide, we’ll walk you through everything you need to know about how to find a good auto loan rate, including tips, strategies, and the key factors to consider to get the best deal.

What is an Auto Loan Rate?

An auto loan rate is the interest rate charged by lenders on the amount of money you borrow to finance a car. This rate is often expressed as an Annual Percentage Rate (APR), which includes both the interest rate and any associated fees. Your APR directly impacts how much you’ll pay for the car over the life of the loan.

The lower the interest rate, the less you’ll pay in interest, which ultimately lowers the overall cost of your car purchase. This is why finding the best auto loan rates is so crucial when shopping for a car loan.

Why Does Your Auto Loan Rate Matter?

The interest rate you secure will have a profound effect on the total cost of your car. For instance, a $20,000 loan for 5 years at a 5% interest rate will cost you $2,641 in interest over the life of the loan. On the other hand, the same loan at a 10% interest rate will cost you $5,276 in interest. Clearly, securing a lower auto loan rate can save you a significant amount of money.

Factors That Influence Auto Loan Rates

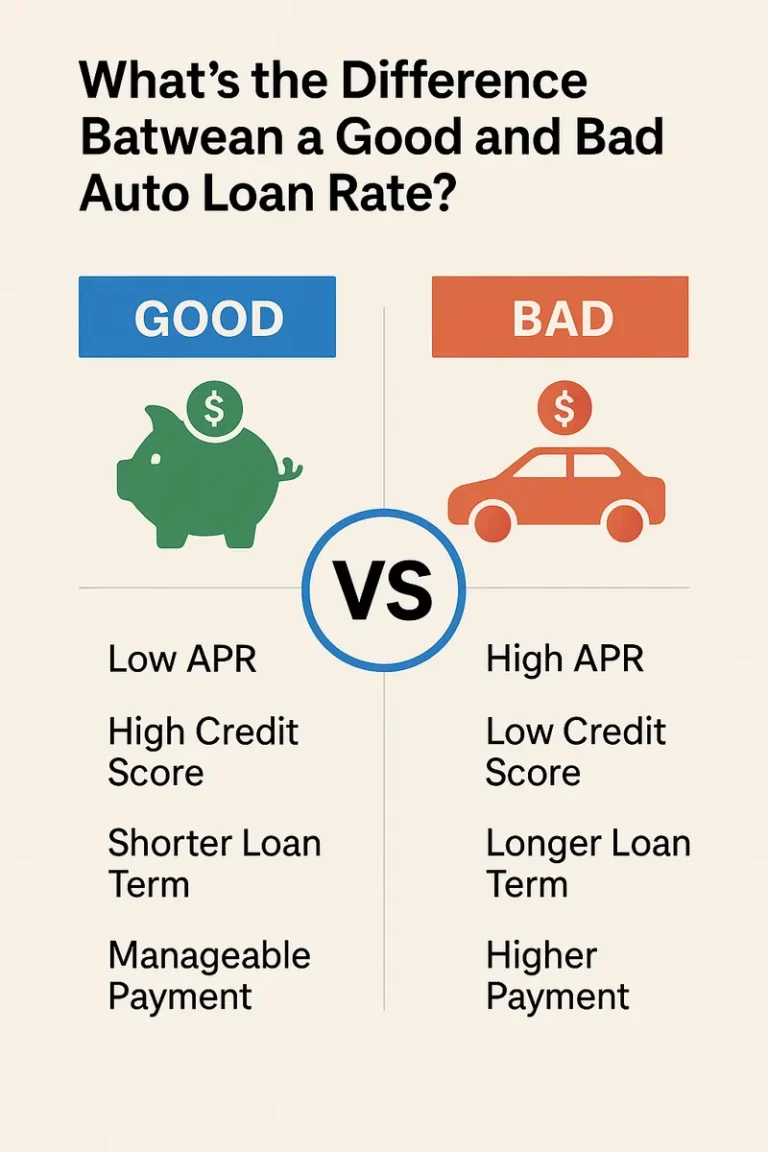

Before diving into the steps of how to find the best auto loan rate, it’s important to understand the factors that influence the rates lenders offer. Here are the key factors:

- Credit Score: Lenders use your credit score to assess your creditworthiness. The higher your credit score, the better the loan rate you’re likely to get. A score of 700 or higher typically qualifies for competitive rates.

- Loan Term: The length of the loan also affects the rate. Shorter loan terms often come with lower rates, but they require higher monthly payments. Longer terms may offer lower monthly payments but at a higher interest rate.

- Down Payment: A larger down payment reduces the amount you need to borrow, which can sometimes result in a better rate.

- Car Type: New cars often come with lower interest rates than used cars. Some manufacturers or dealerships offer promotional rates for new cars, which can further reduce the cost.

- Loan Amount: The size of the loan can also impact your rate. Larger loans may come with higher rates due to the increased risk for the lender.

Steps to Find the Best Auto Loan Rate

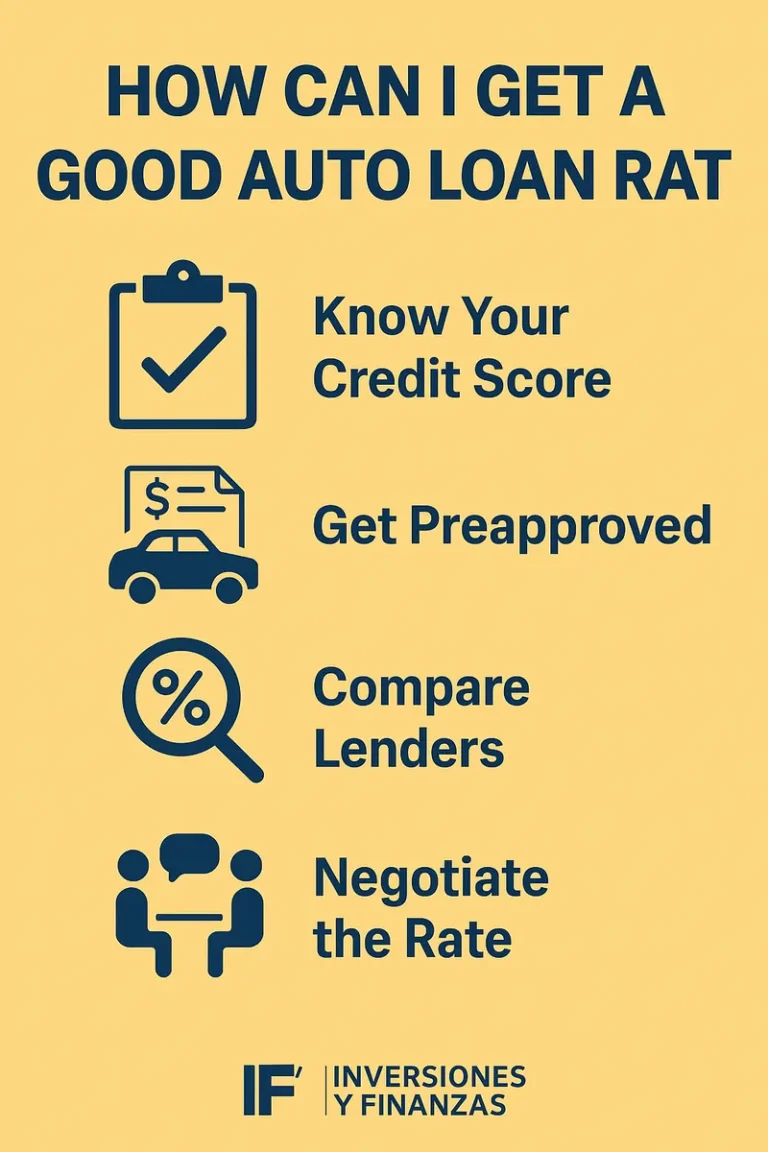

1. Check Your Credit Score

Your credit score plays a crucial role in determining your auto loan rate. Before you start shopping for loans, check your credit score to get an idea of what rates you may qualify for. If your score is less than ideal, consider taking steps to improve it before applying for a loan. Even small improvements in your credit score can result in significantly better loan terms.

2. Compare Auto Loan Rates from Different Lenders

One of the most effective ways to find a good auto loan rate is to shop around. Lenders, including banks, credit unions, online lenders, and car dealerships, all offer different rates. By comparing these rates, you can find the one that suits your financial situation the best. Many websites allow you to compare auto loan rates from multiple lenders quickly and easily.

When comparing rates, be sure to consider the APR, not just the interest rate. The APR reflects the total cost of the loan, including any fees or charges, making it a more comprehensive measure of your loan’s affordability.

3. Get Pre-Approved for an Auto Loan

Getting pre-approved for an auto loan is a great way to ensure that you’re getting the best possible rate. Pre-approval involves submitting a loan application and having a lender assess your creditworthiness. If you’re pre-approved, the lender will provide you with a loan offer, including the interest rate, loan term, and other terms.

Pre-approval also gives you a clear idea of how much you can afford to borrow and helps streamline the buying process. It also provides negotiating power at the dealership.

4. Consider a Larger Down Payment

A larger down payment can help you secure a better interest rate. When you put more money down upfront, you’re borrowing less, which reduces the lender’s risk and may result in a lower interest rate. Additionally, a large down payment can help you avoid paying private mortgage insurance (PMI) if you’re financing a larger portion of the car’s price.

5. Opt for a Shorter Loan Term

Shorter loan terms generally come with lower interest rates. While a shorter loan term means higher monthly payments, it can save you money in the long run by reducing the total interest paid on the loan.

6. Look for Special Financing Offers

Many car dealerships and manufacturers offer special financing promotions, such as 0% APR for new cars. These deals can be especially valuable if you qualify. Keep in mind, however, that such offers often require excellent credit, and there may be restrictions based on the car model or purchase price.

Best Auto Loan Financing Options: Where to Look

When looking for the best financing for cars, you have several options:

- Banks: Traditional banks typically offer competitive rates, especially if you have an established relationship with them. However, the application process may be more time-consuming than other options.

- Credit Unions: Credit unions often provide lower interest rates than banks. They are non-profit institutions, which allows them to pass on savings to their members. If you’re a member of a credit union, it’s worth checking their auto loan rates.

- Online Lenders: Online auto lenders offer convenience and may offer competitive rates, especially if you’re comfortable with digital transactions.

- Dealership Financing: Many car dealerships offer in-house financing, and some provide special promotions like 0% APR on new cars. However, dealership rates may be higher than those offered by banks or credit unions, so it’s important to compare.

Common Auto Loan Mistakes to Avoid

While shopping for auto loans, be mindful of these common mistakes:

- Not Checking Your Credit Score: As we mentioned earlier, your credit score is a key factor in determining your loan rate. Don’t skip this step.

- Choosing the First Loan You’re Offered: Just because you’re pre-approved doesn’t mean it’s the best deal. Always compare different offers before making a final decision.

- Not Reading the Fine Print: Be sure to review the full terms and conditions of your loan. Hidden fees, penalties, and other terms can increase your total cost.

- Financing for Too Long: While longer loan terms can lower your monthly payments, they can also increase the overall cost of the loan. Opt for the shortest loan term that fits your budget.

Conclusion: Securing the Best Auto Loan Rate

Finding a good auto loan rate doesn’t have to be difficult, but it does require some time and effort. By understanding how auto loan rates work and using the tips outlined in this guide, you can secure a loan that fits your financial needs and saves you money in the long run. Start by checking your credit score, comparing rates, and considering a larger down payment or shorter loan term. With these strategies in place, you’ll be well on your way to finding the best financing for your next car purchase.

FAQs: Real Data and Insights

1. What is the average interest rate for an auto loan in 2025?

As of 2025, the average interest rate for a new car loan is approximately 5.14%, while the average for a used car loan is around 7.38%. These rates can vary depending on your credit score and loan term.

2. Can I negotiate my car loan rate?

Yes, you can negotiate your car loan rate, especially if you have a good credit score or if you’re pre-approved for a loan. Dealerships and lenders may be willing to offer a better rate to secure your business.

3. How can I improve my chances of getting a low auto loan rate?

Improving your credit score, saving for a larger down payment, and opting for a shorter loan term are some of the best ways to increase your chances of getting a low auto loan rate.

4. Should I get a loan through my bank or a dealership?

It depends on the rates and terms offered. Dealership financing may offer promotional 0% APR deals, but banks and credit unions generally offer more competitive rates. Always compare offers before deciding.