What Is the Best Auto Loan Rate in 2025?

How to Lock in a Low Rate and Drive Away with Confidence

Introduction: One Rate Can Change Everything

Buying a car is more than a personal milestone — it’s a financial strategy. And in 2025, where interest rates are shifting and inflation still lingers, knowing what is the best auto loan rate can make or break your monthly budget.

At Inversiones y Finanzas Hispano, our mission is to help you make smart money moves. Whether you’re eyeing a new ride or a reliable used car, this guide will walk you through how to find the lowest auto loan interest rate, understand the key factors that affect it, and make a decision that fits your financial future.

What Does “Best” Really Mean When It Comes to Auto Loan Rates?

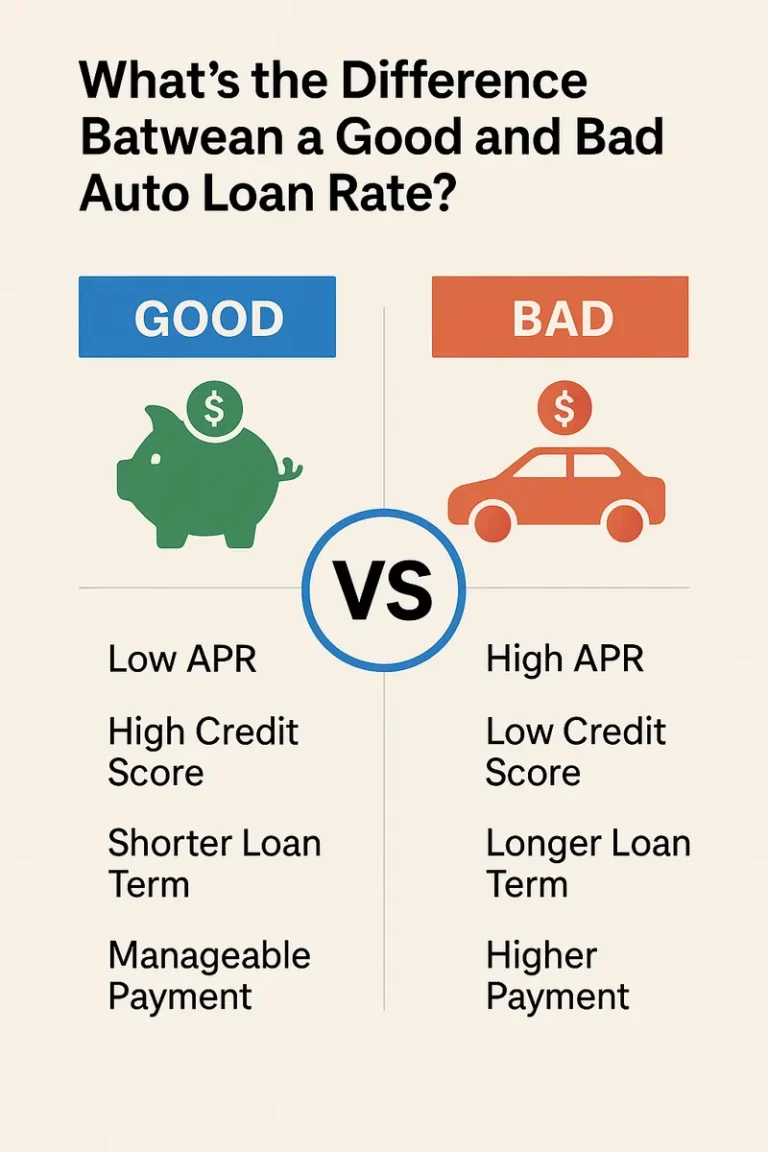

The “best” auto loan rate isn’t always the lowest number on paper. It’s the one that matches your credit profile, budget, and long-term goals. For example, a 3.9% APR might sound amazing — but if it comes with hidden fees or only applies to buyers with perfect credit, it might not actually be accessible for you.

In 2025, the best auto loan rates today range from 5.49% to 7.99% for borrowers with excellent credit, according to recent data from Experian. However, your rate may vary depending on:

- Whether you’re buying a new or used vehicle

- Your credit score

- The loan term (36, 48, 60, or 72 months)

- Whether you finance through a bank, dealership, or credit union

Current Auto Loan Rates in 2025: Where Do We Stand?

Interest rates have ticked up compared to previous years due to inflation-fighting policies from the Federal Reserve. Here’s a breakdown of average auto loan rates today:

| Loan Type | Excellent Credit (720+) | Average Credit (660–719) |

|---|---|---|

| New Car Loan | 5.49% | 7.99% |

| Used Car Loan | 6.19% | 8.79% |

Source: Bankrate Auto Loan Survey – April 2025

As you can see, auto loan rates by credit score matter a lot. The higher your credit score, the better your negotiating power — and the lower your payments.

What Factors Affect Your Auto Loan Rate?

Your auto loan rate isn’t random — lenders evaluate several key factors before deciding what to offer you:

1. Your Credit History

Your FICO score plays a starring role. Scores of 750+ typically unlock the lowest auto loan interest rates. If your score is lower, consider paying off small debts or disputing any errors on your credit report before applying.

2. Type of Car

New car loan rates are usually lower than those for used vehicles. Lenders see new cars as less risky since they’re less likely to need major repairs and retain more value.

3. Loan Term Length

While a longer loan term (72 or 84 months) means lower monthly payments, it often comes with a higher interest rate and more money paid over time. Shorter terms = less interest.

4. Where You Get Your Loan

Shopping around is key. Banks, credit unions, online lenders, and dealerships all offer different auto financing rates. In many cases, credit union auto loan rates are the most competitive — especially if you’re already a member.

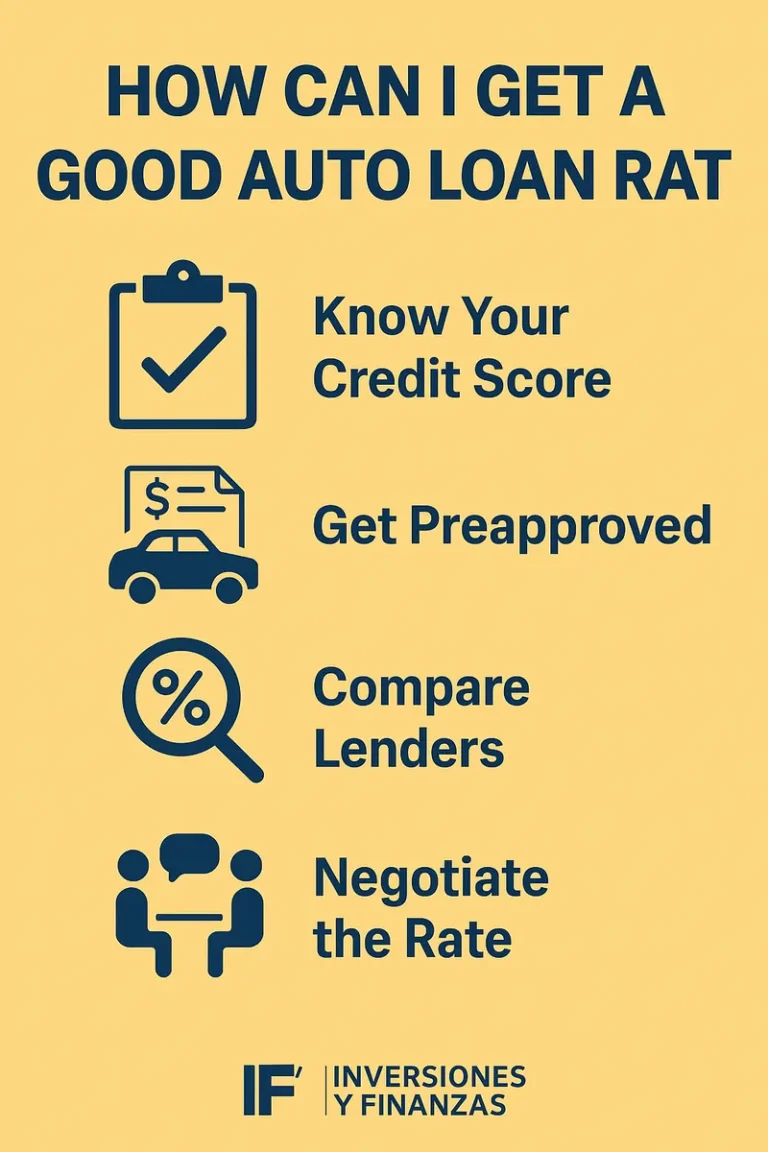

How to Get the Best Auto Loan Rate in 2025

Here are a few practical strategies to secure a competitive car loan rate this year:

✅ Check Your Credit First

Pull a free credit report and fix any errors. This small step can lead to big savings.

✅ Shop Around

Don’t settle for the first offer. Use auto loan rate comparison tools to evaluate options from banks, credit unions, and online lenders.

✅ Negotiate the Car Price Separately

Always negotiate the cost of the vehicle before talking about financing. That way, the dealer can’t offset a low interest rate with a higher car price.

✅ Avoid Unnecessary Add-ons

Gap insurance, warranties, and service packages can significantly raise your total loan amount — and your monthly payments.

Real-Life Example: Carlos Found the Better Deal

Carlos, a young professional in Corinth, Texas, had a credit score of 710 and wanted to finance a 2022 Toyota Corolla. He compared offers from his traditional bank and a local credit union. The credit union’s rate was 2.1% lower. Over a 60-month loan, that saved him over $1,200 in interest. His story proves that comparing rates pays off — literally.

Where to Find Competitive Auto Loan Rates Near You

With tools like Inversiones y Finanzas Hispano, you can easily find auto loan rates near me without visiting multiple banks or dealerships. We connect you with lenders that match your credit profile and help streamline your approval process.

Plus, our experts are ready to guide you toward low interest car loans that make financial sense — not just flashy rates with hidden catches.

Is 2025 a Good Time to Refinance Your Auto Loan?

If you’re stuck with a high-interest car loan, 2025 could be your year to switch. Many lenders are offering lower refinance auto loan rates to borrowers with improved credit or stronger financials. If it’s been 12 months or more since you took out your loan, it might be time to explore your options.

FAQs: Auto Loan Rates in 2025

❓ What is a good auto loan rate in 2025?

A great rate for excellent credit (720+) is around 5.49% for new cars and 6.19% for used cars. If your score is average (660–719), expect rates closer to 7.99%–8.79%.

❓ Can I get a low auto loan rate with bad credit?

It’s possible, especially through subprime lenders or with a co-signer. Improving your credit before applying can dramatically increase your chances of landing a better deal.

❓ What’s the best loan term to choose?

Shorter terms (36–60 months) often come with better auto loan APRs and save you money in interest, even if the monthly payments are higher.

❓ Do credit unions offer the best rates?

Often, yes. Credit union auto loan rates are generally lower than banks and dealerships. Plus, credit unions tend to offer more flexible approval processes.

Final Thoughts: The Rate You Choose Today Shapes Your Financial Future

Choosing the best auto loan rate isn’t just about numbers — it’s about knowing your options, planning ahead, and making smart decisions. In 2025’s market, preparation and research can save you thousands.

At Inversiones y Finanzas Hispano, we believe in giving you the tools and support to make the best financial moves for your future. Ready to compare the best car loan interest rates today?

👉 Click here to start your free auto financing application now