🚗 How Can I Get a Good Auto Loan Rate? | Your Guide to Smarter Car Financing

Buying a car is more than just choosing the right make and model—it’s about securing the best deal possible, and that starts with one crucial step: getting a good auto loan rate.

At Inversiones y Finanzas Hispano, we know the auto loan process can feel overwhelming, especially with so many lenders, interest rates, and financial terms flying around. But don’t worry—you’re not alone in this. Whether you’re buying your first vehicle or upgrading to a newer model, this guide is here to break down exactly how to get a good auto loan rate—step by step, with clarity, confidence, and real data.

🔍 Why Auto Loan Rates Matter More Than You Think

Let’s get real: a few percentage points on your interest rate can mean thousands of dollars over the life of your loan. For example, on a $30,000 car loan over five years:

- At 4% interest, you’ll pay about $3,150 in interest.

- At 9% interest, that jumps to over $7,000.

That’s why securing a lower rate isn’t just smart—it’s essential. It’s not just about monthly payments. It’s about building long-term financial stability.

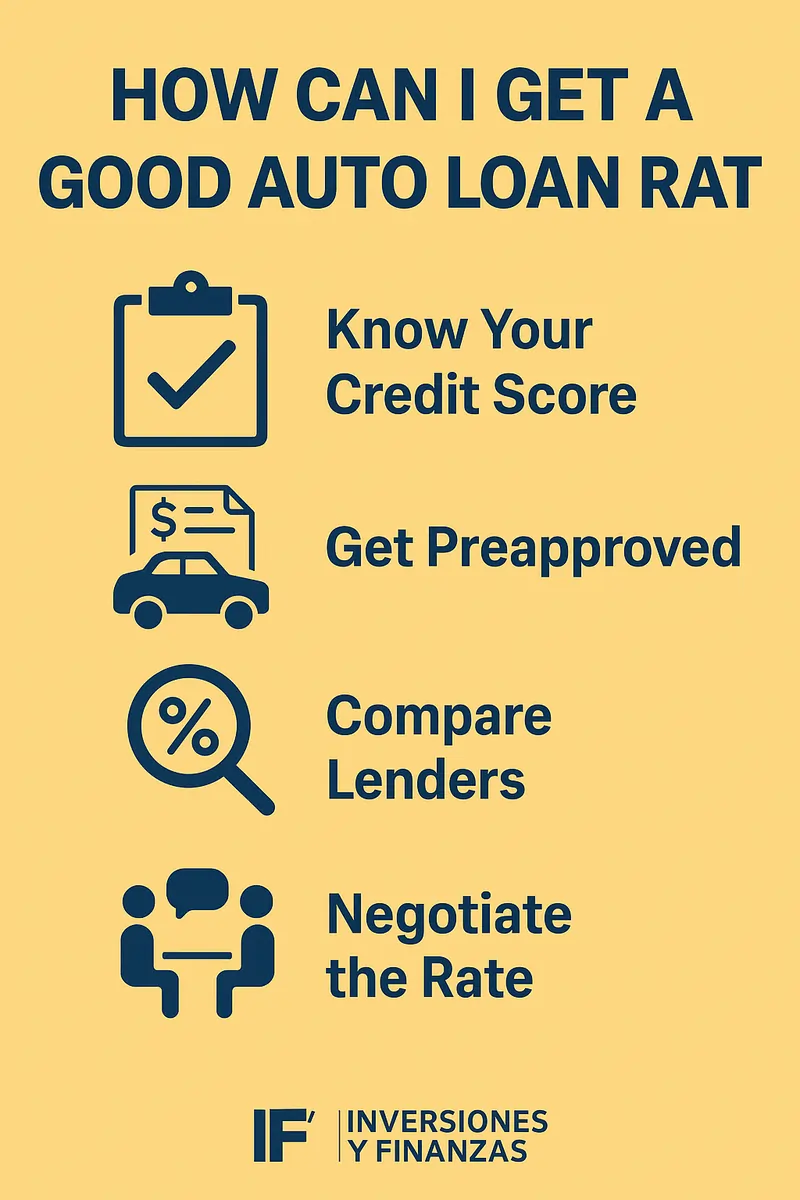

🧭 Step-by-Step: How to Get a Good Auto Loan Rate

1. 🧾 Know Your Credit Score Before You Shop

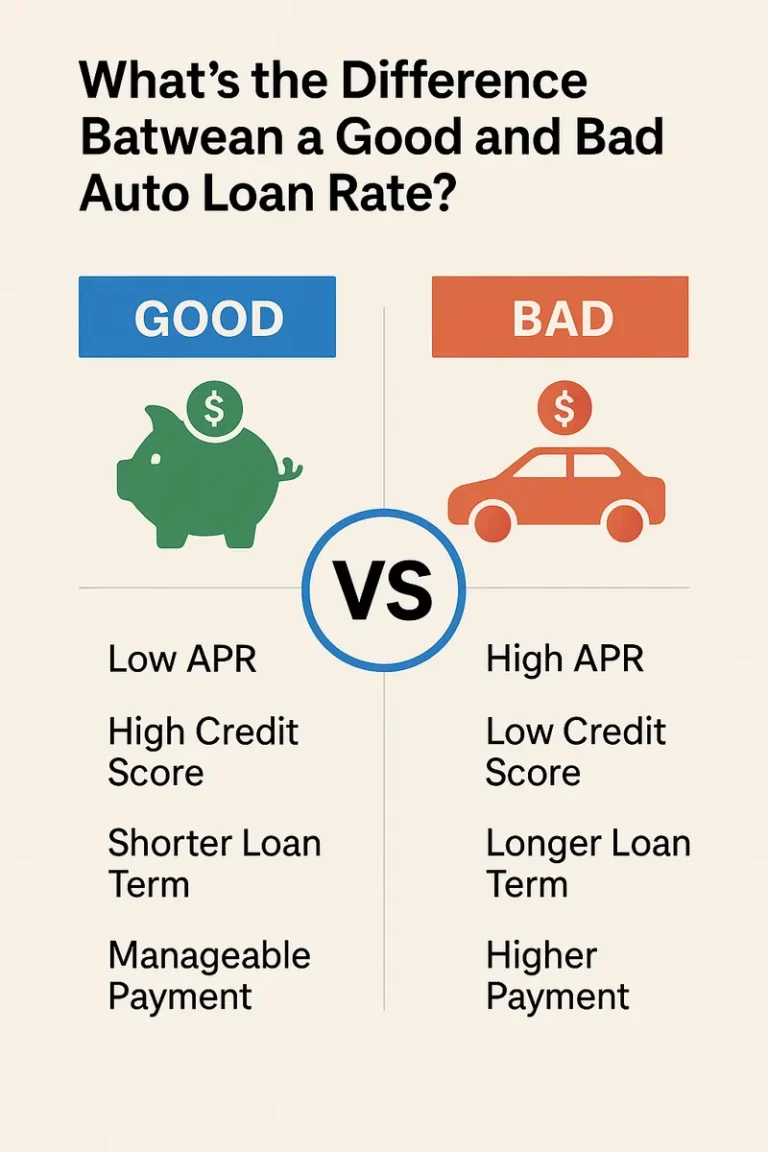

Your credit score plays a massive role in the rate lenders offer you.

- 740 or above: Excellent – you’ll likely qualify for the lowest interest rates available.

- 670–739: Good – you’ll still access competitive offers, though not the lowest.

- 580–669: Fair – you may face higher rates, but options are still available.

- Below 580: Poor – you may need to explore alternative financing solutions.

💡 Pro tip: Check your credit report on sites like AnnualCreditReport.com and dispute any inaccuracies that could lower your score.

2. 🏦 Get Preapproved Before Visiting the Dealership

Preapproval gives you power. It shows sellers you’re serious—and it helps you lock in a competitive rate before any hard negotiations.

Compare preapproved auto loan offers from credit unions, banks, and online lenders. This step alone could save you thousands.

3. 💬 Compare Lenders — Don’t Just Settle for the First Offer

Different lenders offer different rates—even if your credit score is the same.

We recommend using online tools that allow for auto loan rate comparison. Check out:

- Credit unions (usually offer low interest car loans)

- National banks

- Online lenders with affordable car loan options

Think of it like shopping for flights. The more you compare, the better the deal.

📊 Real Data: Average Auto Loan Rates in 2025

According to the Federal Reserve and Experian’s State of the Automotive Finance Market Report, here’s the current average:

| Credit Score Range | Avg. Interest Rate (New Cars) | Avg. Rate (Used Cars) |

|---|---|---|

| 781-850 | 5.18% | 6.79% |

| 661-780 | 6.64% | 8.75% |

| 601-660 | 9.58% | 13.06% |

| 501-600 | 12.84% | 17.91% |

| 300-500 | 14.76% | 20.99% |

🧠 Insight: Even improving your score by one tier could slash your rate by over 4%.

💡 Tips for Getting Low Auto Loan Rates

Let’s dive deeper into practical strategies that could help you qualify for low car loan rates.

🔄 Consider a Co-Signer

If your credit isn’t strong, a trusted co-signer with good credit can help you secure better terms.

💸 Make a Larger Down Payment

Putting more money down reduces the amount you borrow—and often earns you a lower interest rate.

⏱ Choose a Shorter Loan Term

Longer terms mean lower monthly payments, but more interest over time. A 36- or 48-month term often qualifies for lower rates than a 72-month one.

🛠 Improve Your Credit Before Applying

Small steps like paying down credit card debt or avoiding new credit inquiries can lead to better rates in just a few months.

🤝 Negotiating Auto Loan Rates: Yes, You Can

Most people don’t realize it, but auto loan rates are negotiable. Don’t be afraid to:

- Show your preapproval offers to the dealer.

- Ask for a rate match or better terms.

- Negotiate both the vehicle price and the loan terms separately.

📣 Anecdote: One of our clients in Texas dropped their rate from 9.2% to 6.3% just by showing a better offer from a credit union. Don’t leave money on the table!

🌐 Should You Refinance?

If you already have a car loan, refinancing could lower your rate—especially if:

- Your credit score has improved

- Interest rates have dropped

- You didn’t shop around the first time

Use online calculators to explore refinance car loan for better rate options and crunch the numbers.

🧠 Final Thoughts: Make Smart Car Financing Decisions

Getting the best auto loan isn’t just about rates—it’s about financial strategy. At Inversiones y Finanzas Hispano, we help our clients make smarter, more informed decisions every day. Whether you’re in Corinth or anywhere across the country, the goal is the same:

✅ Avoid overpaying

✅ Build financial confidence

✅ Drive away with peace of mind

Remember: the journey to a better rate starts with asking the right question—“How can I get a good auto loan rate?”

Now that you know the answer, it’s time to take action.

📌 Frequently Asked Questions

❓ What is considered a good auto loan rate in 2025?

As of early 2025, a good auto loan rate for someone with excellent credit (781+) is typically around 5% or less for new cars. Used car loan rates tend to be slightly higher, even for strong credit profiles.

❓ How much can my credit score impact my auto loan rate?

A lot. For example, someone with a 750 score might get a 5% rate, while someone with a 620 might see offers of 10% or higher—that could mean thousands more in interest over time.

❓ Can I get a good auto loan rate with bad credit?

Yes, but you may need to explore options like credit unions, buy-here-pay-here dealerships, or consider a co-signer. Making a larger down payment also helps.

❓ Is it better to get a loan from the dealer or my bank?

Often, preapproval through a credit union or bank gives you the upper hand in negotiations. Dealers may offer competitive financing—especially during promotional periods—but always compare offers first.

❓ How can I lower my auto loan rate after getting a loan?

You can refinance your auto loan—especially if your credit has improved or market rates have dropped. Just be sure to compare closing costs and fees to make sure it’s worth it.

📞 Ready to Secure the Best Auto Loan Rate?

At Inversiones y Finanzas Hispano, we don’t just help you apply for financing—we help you understand your options, navigate your credit, and get the best possible rate. Let us walk with you on the road to financial freedom.

👉 Visit our website or contact us today to start your journey toward smarter car ownership.