How to Calculate Adjusted Gross Income: Your Step-by-Step Guide to Understanding AGI

Understanding your Adjusted Gross Income (AGI) isn’t just about filling out a tax form correctly—it’s about taking control of your financial future. Whether you’re applying for student aid, evaluating eligibility for tax credits, or planning long-term investments, knowing how to calculate your AGI can open doors and reduce stress.

At Inversiones y Finanzas Hispano, we believe financial literacy is key to achieving stability and success. This guide will walk you through everything you need to know about how to calculate adjusted gross income in a clear, approachable way.

Let’s begin by laying the foundation, then dive deeper with practical examples, formulas, and expert insights.

What Is Adjusted Gross Income (AGI)?

Adjusted Gross Income (AGI) is your total gross income for the year minus specific deductions, also known as “adjustments to income.” It is the starting point for determining your taxable income and, by extension, how much you owe the IRS or how much you could receive as a refund.

AGI is used to:

- Determine your eligibility for tax credits and deductions

- Calculate your federal tax liability

- Assess qualifications for financial aid or healthcare subsidies

Expert Insight: “AGI is like the financial heartbeat of your tax return. It’s the number that most credits and limitations flow from,” says Clara Vázquez, CPA and tax advisor based in Miami.

Gross Income vs. Adjusted Gross Income

Your gross income includes all earnings:

- Wages and salaries

- Interest and dividends

- Capital gains

- Business income

- Rental income

- Alimony (pre-2019 agreements)

Your AGI is that total minus specific IRS-approved deductions. These can include:

- Educator expenses

- Student loan interest

- IRA contributions

- Self-employment taxes

- Health Savings Account (HSA) contributions

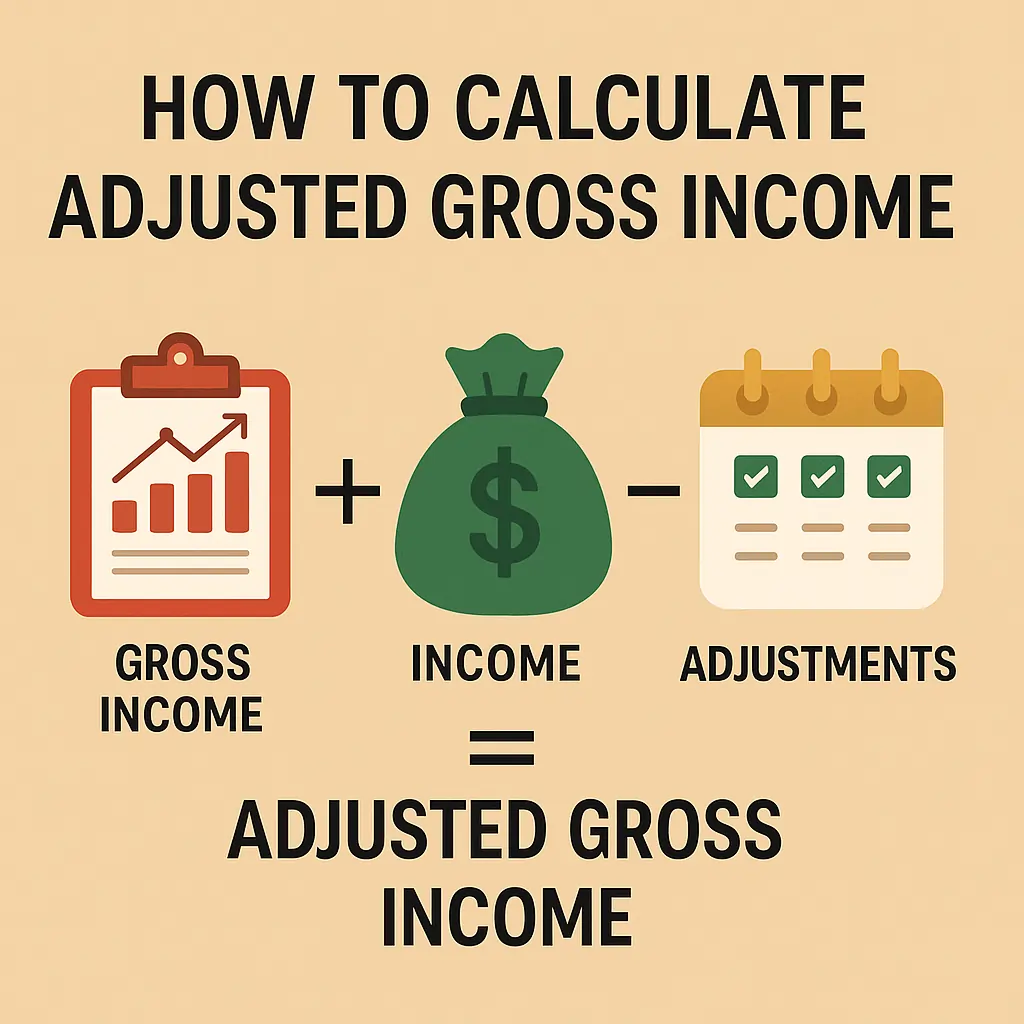

How to Calculate Adjusted Gross Income (AGI)

Calculating your AGI is straightforward once you know what to include and subtract. Here’s the step-by-step breakdown:

Step 1: Calculate Your Total Gross Income

Add up all your income sources. That includes:

- W-2 wages (Box 1 on your W-2 form)

- 1099 income

- Tips, side gigs

- Rental or investment income

Example: Carlos earns $48,000 in salary, $3,000 from freelance work, and $2,000 in investment gains. His total gross income is $53,000.

Step 2: Identify Your Adjustments to Income

These are your IRS-approved deductions. Common ones include:

- $2,500 student loan interest

- $6,000 in traditional IRA contributions

- 50% of self-employment tax

Tip: Use an AGI calculator or worksheet (available on the IRS site) for accuracy.

Step 3: Subtract Deductions From Gross Income

Example continued: Carlos has $4,000 in adjustments. His AGI is:

$53,000 – $4,000 = $49,000

This $49,000 is now his Adjusted Gross Income.

Where to Find AGI on Your Tax Return

You can find your AGI on:

- Form 1040: Line 11 (as of tax year 2023)

- IRS transcript if you need prior-year AGI for e-filing

Note: If you’re self-employed or using multiple income sources, you may want to consult a tax professional.

AGI vs. MAGI: What’s the Difference?

MAGI, or Modified Adjusted Gross Income, takes your AGI and adds back certain deductions like:

- Foreign earned income exclusion

- Tax-exempt interest

MAGI is often used for eligibility in:

- Roth IRA contributions

- Premium tax credits

- Income-driven student loan repayment plans

Quick Tip: Always check the IRS website or your tax advisor to understand which income metric applies to your situation.

How AGI Affects Your Financial Life

Your AGI plays a critical role in:

- Tax Credits: Higher AGI may reduce or eliminate your eligibility for things like the Earned Income Tax Credit (EITC) or Child Tax Credit.

- Student Loans: Income-driven repayment plans often rely on AGI.

- Health Insurance Subsidies: ACA marketplace plans use AGI to determine your premium costs.

Real-Life Example: Ana, a Miami teacher, lowered her AGI by contributing to an IRA and qualifying for a $1,500 education credit that she would have missed with a higher AGI.

Federal AGI Calculation Tools

Looking to simplify the process? Use free tools like:

- IRS Interactive Tax Assistant

- TurboTax AGI calculator

- TaxSlayer or FreeTaxUSA estimators

How to Lower Your AGI Legally

Want to reduce your tax burden? Here are smart ways to legally reduce your AGI:

- Contribute to a traditional IRA

- Max out your HSA

- Deduct student loan interest

- Claim self-employment expenses

- Consider above-the-line charitable deductions (if applicable)

Potential Pitfalls When Calculating AGI

Even a small mistake can impact your entire tax situation. Common errors include:

- Forgetting 1099 income (especially from gig work)

- Not deducting allowable student loan interest

- Missing contributions to qualified retirement accounts

Pro Insight: “Always double-check the latest IRS forms. Tax rules shift yearly, and what was deductible last year may not apply today,” advises Gabriel Ortiz, EA.

FAQs: How to Calculate Adjusted Gross Income

1. What line is AGI on 1040 for 2023?

AGI is listed on Line 11 of IRS Form 1040.

2. Can I calculate AGI without a tax preparer?

Yes, if your finances are straightforward, you can use IRS tools or online tax software.

3. How does AGI affect my refund?

Your AGI determines your eligibility for deductions and credits, which directly impact your refund or taxes owed.

4. What if I made a mistake calculating AGI?

You can file an amended return using IRS Form 1040-X.

5. Is AGI used for FAFSA?

Yes. FAFSA uses AGI to determine student aid eligibility.

6. Where can I find a free AGI calculator?

You can use the IRS Free File tool or sites like TurboTax and H&R Block.

Final Thoughts: AGI Is More Than Just a Number

At its core, knowing how to calculate adjusted gross income gives you financial leverage. It helps you make informed decisions, qualify for benefits, and plan smarter for the future. Whether you’re filing your own taxes or preparing for a financial milestone, understanding AGI is an essential step toward financial clarity.

Visit Inversiones y Finanzas Hispano for more expert tips, resources, and tools to empower your financial journey.

Ready to take control of your AGI? Explore our AGI calculator tools and guides, and start optimizing your tax situation today.