How to Calculate Adjusted Gross Income for Taxes: A Complete Guide for Smarter Filing

When tax season rolls around, one term you’ll hear over and over again is “Adjusted Gross Income“ (AGI). But what does it actually mean, and more importantly—how do you calculate your adjusted gross income for taxes? Whether you’re filing on your own or working with a tax professional, understanding your AGI is essential for getting your taxes right and maximizing your deductions.

In this guide, brought to you by inversionesyfinanzashispano.shop, we’ll break it all down in plain English. You’ll walk away knowing exactly how to calculate adjusted gross income, how it affects your tax return, and why getting it right could save you thousands.

What Is Adjusted Gross Income (AGI)?

Your Adjusted Gross Income is essentially your total income for the year—minus specific deductions known as adjustments to income. It’s the figure the IRS uses as a starting point to determine how much tax you owe.

“Think of your AGI as the bridge between your total income and your taxable income. It’s where your tax strategy really begins.”

Your AGI is used to determine your eligibility for numerous tax credits and deductions, such as:

- Education credits

- Retirement contributions

- Medical expense deductions

- The Child Tax Credit

- Roth IRA contributions

- Healthcare subsidy qualifications

Why Knowing How to Calculate Adjusted Gross Income Matters

Imagine two people with the same salary—one ends up owing $2,000 in taxes, the other gets a refund. Why? Because one of them understood how to calculate AGI and used available deductions to reduce their taxable income.

Whether you’re a freelancer juggling multiple income streams or an employee with just a W-2, your AGI plays a crucial role in your tax outcome.

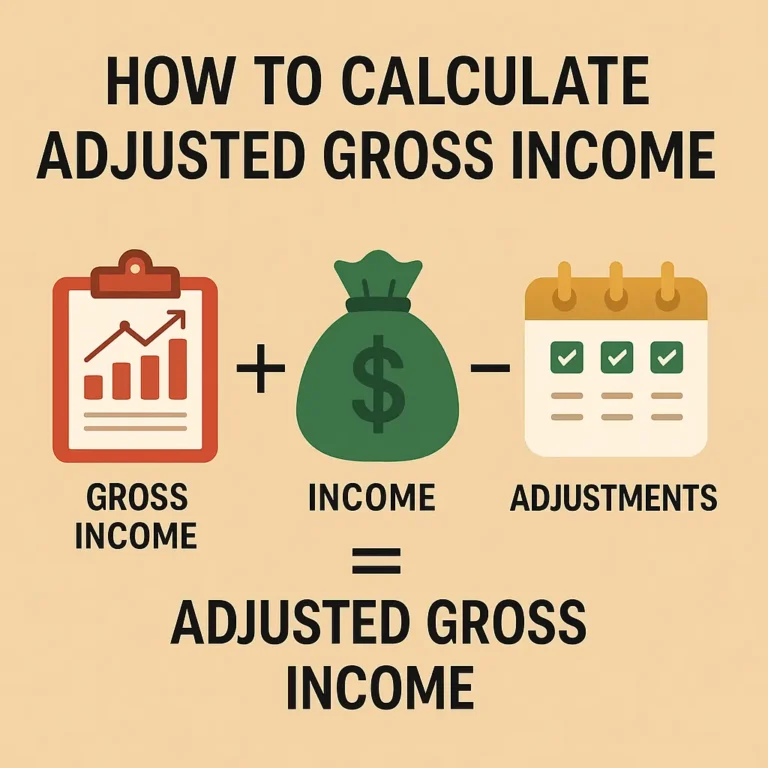

Step-by-Step: How to Calculate Adjusted Gross Income for Taxes

Let’s get down to the nitty-gritty. Here’s how to figure out your AGI:

Step 1: Add Up Your Gross Income

This includes:

- Wages, salaries, and tips (Form W-2)

- Business income (Schedule C)

- Interest and dividends

- Rental income

- Capital gains

- Unemployment compensation

- Retirement distributions (401(k), IRA, pensions)

Example:

- Salary: $65,000

- Freelance income: $12,000

- Dividends: $2,000

- Total Gross Income = $79,000

Step 2: Subtract “Adjustments to Income”

These are deductions that reduce your gross income to reach your AGI. Common ones include:

- Student loan interest (up to $2,500)

- Educator expenses (up to $300)

- Contributions to traditional IRAs

- Health Savings Account (HSA) contributions

- Self-employment tax (50%)

- Alimony paid (for divorces before 2019)

- Tuition and fees (if eligible)

Continuing the Example:

- Student loan interest: $2,000

- HSA contribution: $3,000

- Self-employment tax deduction: $850

- Total Adjustments = $5,850

Step 3: Final AGI Calculation

$79,000 – $5,850 = $73,150

That’s your Adjusted Gross Income.

Where to Find AGI on Your Tax Return

Look for it on:

- Form 1040 (Line 11)

- It will also appear on your IRS transcript if you’re retrieving your previous year’s AGI for e-filing purposes.

How AGI Impacts Your Tax Liability

Your AGI is like a gatekeeper—it determines what tax breaks you’re eligible for. The lower your AGI, the more likely you are to qualify for valuable deductions and credits.

Here’s how:

- Medical expense deductions only apply to costs over 7.5% of AGI

- Education credits phase out at higher AGI levels

- Roth IRA contributions are limited or phased out based on AGI

Tax tip: Reducing your AGI could mean thousands in savings. Don’t skip this step.

Real-Life Scenario: How Lowering AGI Saves Money

Let’s say Maria earns $90,000 and contributes $6,000 to a traditional IRA and $3,000 to an HSA. By reducing her AGI to $81,000, she now qualifies for an education tax credit for her son’s tuition that she wouldn’t have been eligible for at the $90K level.

That’s real money—saved by strategic financial planning.

Common Mistakes to Avoid

- Forgetting income streams (like side gigs or bank interest)

- Missing adjustments like HSA contributions or educator expenses

- Confusing AGI with taxable income — they’re not the same!

Expert Insight

According to tax expert Juan Delgado, CPA:

“One of the biggest missed opportunities I see is people not contributing to tax-advantaged accounts like IRAs or HSAs. These directly reduce AGI and can lower your tax bill significantly.”

Future Outlook: AGI in a Changing Tax Landscape

With potential tax code changes on the horizon, knowing your AGI isn’t just smart—it’s essential. More credits and deductions are tied to AGI thresholds than ever before. Tax planning now includes AGI as a cornerstone.

Frequently Asked Questions (FAQs)

What is the difference between AGI and taxable income?

AGI is your income after adjustments but before standard or itemized deductions. Taxable income is what you pay taxes on after those deductions.

How can I reduce my adjusted gross income?

Contribute to retirement accounts, HSAs, and track deductible expenses like student loan interest or self-employment taxes.

Is AGI used to determine eligibility for financial aid?

Yes, your AGI is a core component of the FAFSA and helps determine your Expected Family Contribution (EFC).

Where can I find my AGI on last year’s tax return?

On Form 1040, Line 11.

What is a good AGI for tax purposes?

There’s no “perfect” AGI, but a lower AGI often opens the door to more deductions and credits.

Final Thoughts: Your AGI is More Than a Number

Understanding how to calculate adjusted gross income for taxes is one of the smartest financial moves you can make. It’s not just about compliance—it’s about strategy.

At inversionesyfinanzashispano.shop, we help people like you gain clarity around their personal finances. Whether you’re navigating your first tax return or optimizing for retirement, knowing your AGI is step one.

Ready to take control of your tax strategy? Explore our financial tools and expert insights at inversionesyfinanzashispano.shop today.