What’s the Difference Between a Good and Bad Auto Loan Rate? | Inversiones y Finanzas Hispano

When you’re in the market for a new or used car, your auto loan rate can be the difference between financial freedom and years of unnecessary debt. But what’s the difference between a good and bad auto loan rate, really? Is it just about the numbers—or is there more to the story?

At Inversiones y Finanzas Hispano, we specialize in breaking down complex financing topics into easy-to-understand, actionable advice—especially for Hispanic families and individuals looking to make smart, informed decisions. Let’s dive deep into the real difference between a good and bad auto loan rate, and what you can do to secure the best deal possible.

Understanding Auto Loan Rates: The Basics

Before we get into the difference between good and bad auto loan rates, let’s first understand what an auto loan rate actually is. In simple terms, it’s the interest rate your lender charges for borrowing money to finance a car. It’s usually expressed as an Annual Percentage Rate (APR), and it affects how much you’ll pay overall for your vehicle.

Good auto loan rates mean paying less over the life of your loan. Bad auto loan rates mean higher monthly payments and more money spent in the long run.

Real-Life Example: Imagine two people buy the same car for $20,000. One has a loan at 4% APR, the other at 12% APR. The person with the 4% rate could save over $2,500 in interest over a 5-year loan term.

What Determines Your Auto Loan Rate?

There’s no one-size-fits-all when it comes to auto loan interest rates. Lenders assess multiple factors to decide what kind of rate you qualify for:

1. Credit Score

Your credit score plays a critical role in your auto loan rate. A high score (typically 700 or above) can land you a low auto loan rate, while a poor credit score (below 600) could result in high interest rates or even a loan denial.

- Excellent Credit (720+): Rates as low as 3.5% APR

- Fair Credit (600-699): Rates between 6% – 11% APR

- Poor Credit (<600): Rates can exceed 14% APR

2. Loan Term Length

A longer loan term might mean lower monthly payments, but it often comes with higher interest rates. A 36-month loan might offer a better rate than a 72-month loan.

Think of it this way: the longer you owe money, the more risk the lender takes—and they charge you for that risk.

3. New vs. Used Car Loans

New car loans usually come with lower interest rates than used ones. That’s because new cars are more valuable and easier to collateralize. However, used cars are cheaper overall, so it depends on your priorities.

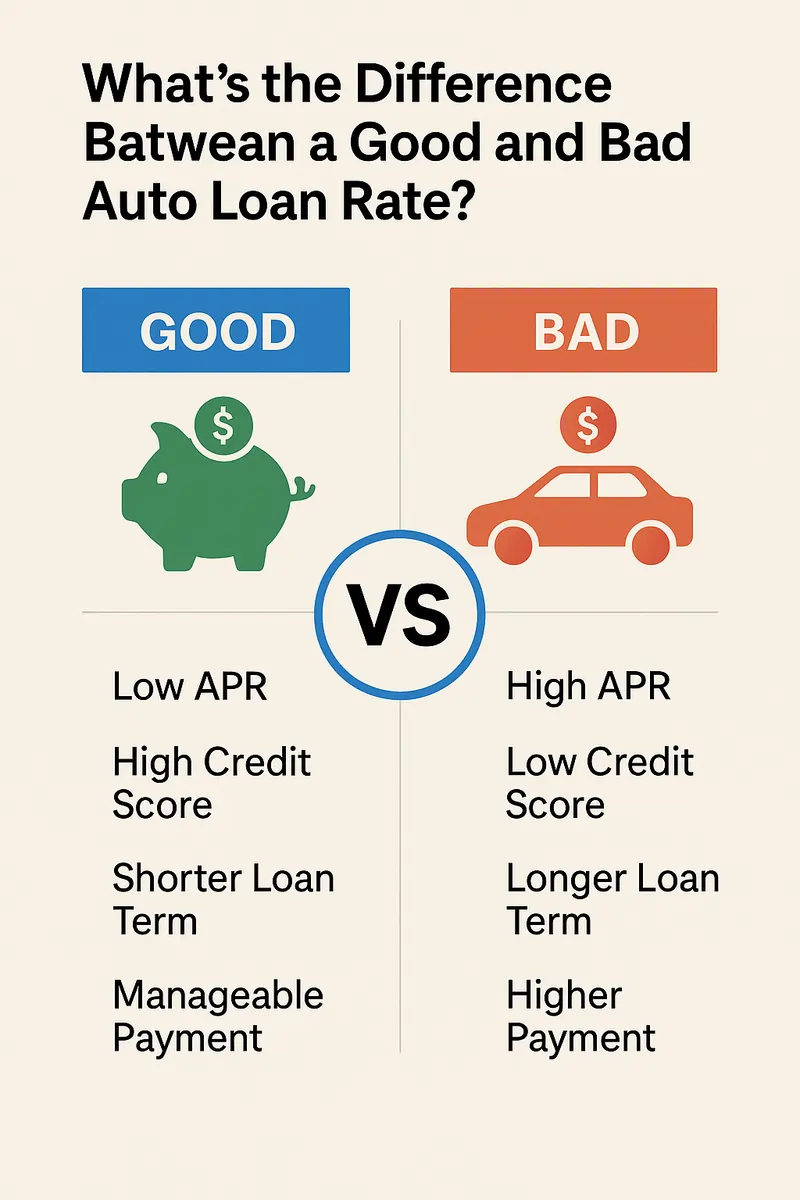

So, What’s the Difference Between a Good and Bad Auto Loan Rate?

The line between good and bad is drawn by how much interest you pay over time—and whether you’re building financial health or draining your wallet.

| Criteria | Good Auto Loan Rate | Bad Auto Loan Rate |

|---|---|---|

| APR Range | 2.99% – 6% | 10% – 20%+ |

| Based on Credit Score | 680+ | Below 620 |

| Loan Term | Shorter (36-60 months) | Longer (72-84 months) |

| Monthly Payment | Reasonable and manageable | Often higher or misleadingly low |

| Long-Term Cost | Less interest overall | Thousands more in interest |

How to Get a Good Auto Loan Rate

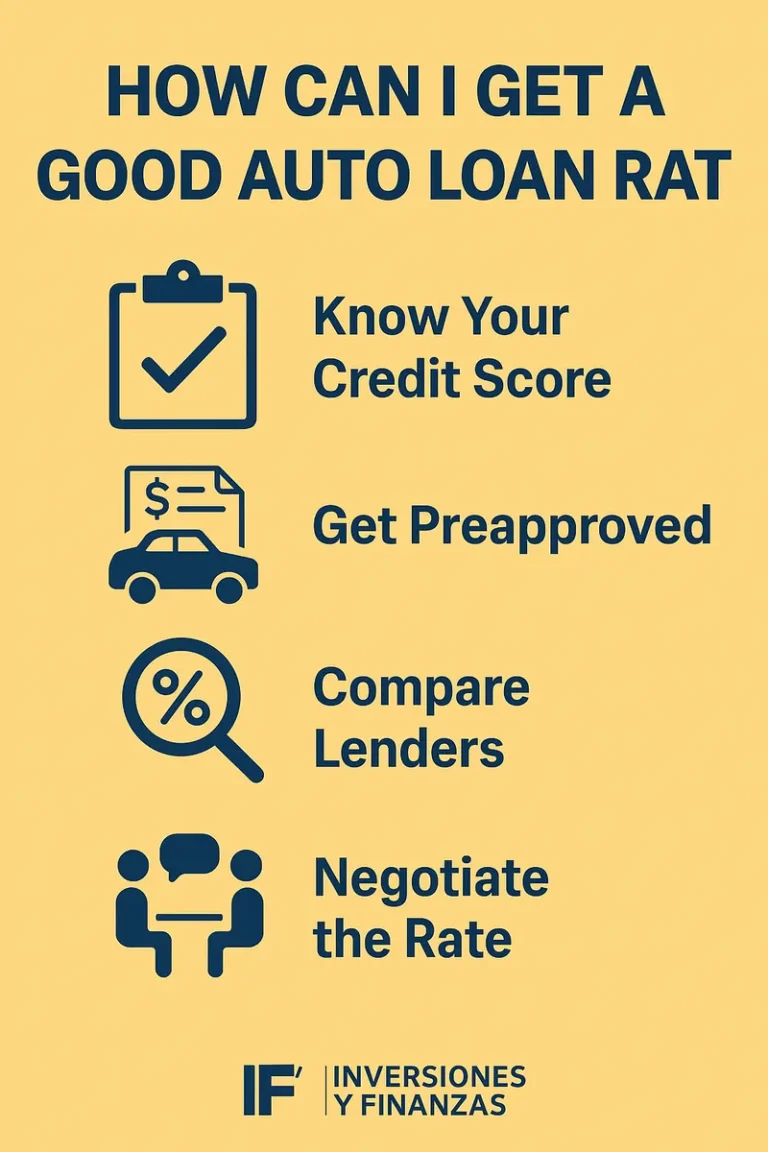

1. Check Your Credit First

Before applying, pull your credit report. Fix any errors, pay down existing debts, and avoid opening new lines of credit right before applying.

2. Shop Around for the Best Auto Loan Rates

Don’t just settle for the dealership’s financing. Compare offers from banks, credit unions, and online lenders. Many people don’t realize they can save hundreds—if not thousands—just by comparing rates.

3. Consider Pre-Approval

Getting pre-approved for an auto loan puts you in the driver’s seat—literally. It gives you a clear budget and more negotiating power.

Common Auto Loan Mistakes to Avoid

Even smart shoppers can fall into common traps. Here are some mistakes that lead to bad auto loan rates:

- Not checking your credit beforehand

- Focusing only on monthly payments

- Ignoring the total interest paid

- Failing to negotiate loan terms

- Financing through the first offer you get

Expert Insight

“Many consumers only think about the monthly payment, but forget to consider the total cost of the loan over time. That’s where most people end up overpaying.”

— Juan Morales, Auto Finance Specialist at Inversiones y Finanzas Hispano

Why It Matters to You

In the Hispanic community, buying a car is often more than a financial transaction—it’s about supporting your family, getting to work, and moving forward in life. Securing a good auto loan rate means building wealth and avoiding financial setbacks. Don’t let poor financing trap you in a cycle of debt.

At Inversiones y Finanzas Hispano, we’re here to help you understand your financing options in a way that’s clear, supportive, and tailored to your goals.

Final Thoughts: Don’t Settle for a Bad Deal

Knowing the difference between a good and bad auto loan rate empowers you to make informed decisions. By checking your credit, comparing offers, and understanding the terms of your loan, you can set yourself up for success—and save money in the process.

Whether you’re buying your first car or upgrading to a newer model, take the time to understand your financing options. The right loan can open doors. The wrong one can close them.

Frequently Asked Questions (FAQs)

Q1: What is considered a good auto loan rate in 2025?

A good auto loan rate in 2025 typically ranges from 2.99% to 6% APR for individuals with strong credit scores (680 and above). Rates vary depending on the lender, loan term, and whether you’re financing a new or used vehicle.

Q2: What is a bad auto loan rate?

Anything above 10% APR is generally considered a bad auto loan rate—especially if you have good credit. High rates often result from poor credit, long loan terms, or predatory lending practices.

Q3: How much can I save by securing a better rate?

If you’re borrowing $20,000 for five years:

- At 4% APR: You’ll pay about $2,100 in interest.

- At 12% APR: You’ll pay over $6,700 in interest. That’s a difference of more than $4,500!

Q4: Do I need perfect credit to get a good loan rate?

Not necessarily. While excellent credit helps, many lenders offer competitive rates to borrowers with fair or average credit—especially if you have steady income, low debt, and a solid payment history.

Q5: Can I refinance a bad auto loan?

Yes! Refinancing can help you lower your rate and monthly payments, especially if your credit has improved since you first took out the loan.

Ready to Drive Away with a Great Deal?

Don’t let confusion or misinformation stop you from making a smart decision. At Inversiones y Finanzas Hispano, we’re here to help you navigate your auto financing journey with confidence. Whether you’re buying your first vehicle or upgrading, we’ll guide you every step of the way.

👉 Visit us today at inversionesyfinanzashispano.shop to learn more about how to get the best auto loan rate tailored for your needs!